Welcome to visit Best Partner Service Center,One-Stop Service for Logistics,Chinese Visa,Tax Account, Payment!

Welcome to visit Best Partner Service Center,One-Stop Service for Logistics,Chinese Visa,Tax Account, Payment!

Release time:2022-04-13

Views:1415

Tax Service

Tax planning is important as it enables company to save money for business development and expansion. Our professionals provide consulting advice to both companies and individuals to efficiently plan their corporate tax and personal tax respectively.

Our tax services include:

1. Tax Establishment and Revision

2. Tax exemption, Compensation and Refund

3. Advice on profits tax for companies

4. Advice on tax planning for sole traders, partnerships and individuals

5. Advice on estate and stamp duty planning

6. Representation of clients in tax objections and appeals

7. Tax Regulation and Policy Inquiries

8. Taxation difficulties clearance

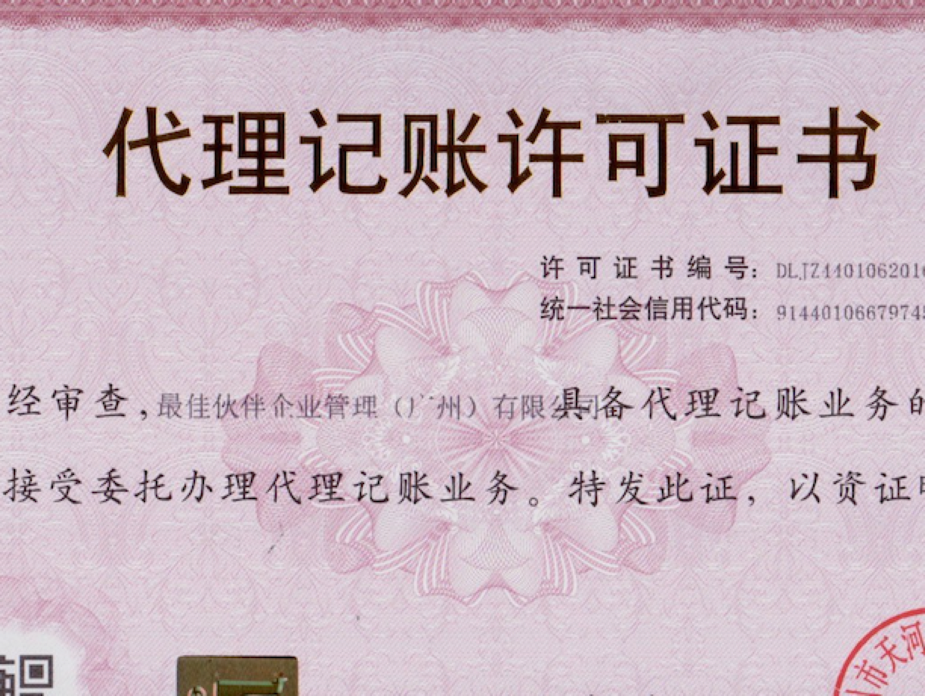

IMPORTANT NOTICE:only it have Finance Dep. approved the certificate,the firm can start to provice the account service.if without this certificate,it can not work legally in China.

Audit Service

1. Audit report

2. Capital report

3. Income tax liquidation

4. Foreign Exchange annual inspection report

Audit Report

The audit report is the written document presented to the principal, authorizer or other statutory recipients by the auditors or audit institution responsible for fulfilling an Audit assignment. The audit report referred to herein is the audit report that is prepared by the audit team and submitted to the audit institution in the conduct of government audits. It is a written document that the audit team presents to its dispatching audit institution at the completion of field audit about the fulfillment of audit tasks and achievement of audit results

The conduct of the audit

The conduct of audit covers two aspects

◆ Information about the audit including work done by the audit team, audit procedure and methods adopted by the audit team, adjustments made to the audit programs and fulfillment of audit tasks.

◆ Confirmation of facts related to audit items after the completion of audit such as disclosure of revenues and expenditures of the audited body

Audit findings

Disclosure of problems existing in audit items is an important component of the audit report and a concrete reflection of audit achievements. Audit findings refer to irregular actions of revenues and expenditures that are committed by the audited body and discovered by the auditors in the course of audit. In the report, auditors should explain such findings, covering the following aspects:

◆ Details about revenues and expenditures that are in violation of relevant state laws and regulations;

◆ Causes for such irregularities;

◆ Details of provisions that have been violated;

◆ Impacts or consequences of the irregularities

Requirements for a quality report

To ensure that the audit report is of high quality and plays an effective role, auditors should meet the following requirements in preparing the report:

◆ Clear facts and true data

◆ Complete contents and clear priorities

◆ Clear arrangement of ideas and reasonable structure

◆ Sufficient evidence and correct judgment

◆ Concise wording and accurate expression

◆ Compliance with principles and adherence to facts

Best Partner Service Center

Since 2008

WhatsApp/Wechat:13710343582

Best Partner Service Center All rights reserved. The content (including but not limited to text, photo, multimedia information, etc) published in this site belongs to Best Partner. Without written authorization from Best Partner, such content shall not be republished or used in any form.2008-2024